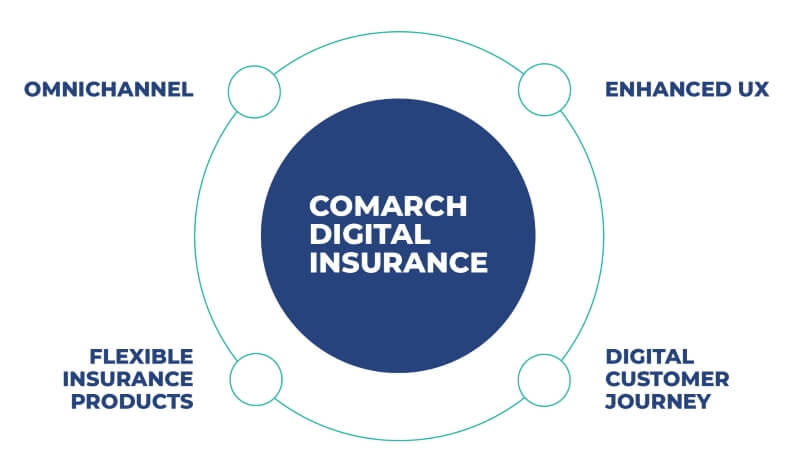

What is Comarch life insurance software and how does it support life and pension products?

Comarch Life Insurance allows for an efficient management of all areas of insurance business, including defining products, offer presentation, underwriting, policy operations, fund management, settlements, reserve calculation and reporting. The life insurance software, offered by Comarch, supports both life & pensions business line as well as local, cross-border and pan-European products for remote and expatriate employees.

Comarch Life Insurance is a platform which can handle any type of protection insurance products with possible extension to health insurance. In terms of pension insurance, our solution supports both defined benefit and defined contribution products. Additionally, different type of investment vehicles can be supported: traditional, unit-linked, or dedicated ones. All these products can be handled under one group insurance contract.

What are the features of Comarch Life Insurance software?

- support for both individual and group life business

- product development including the actuarial calculation engine, the rate table and the update management tool

- extended scope of stored data and interfaces

- full policy life cycle support – quotation and application management, policy issuance, ongoing contract administration and endorsements

- possible extension for collection and disbursement support, as well as technical sub-ledger accounting

- comprehensive and ergonomic policy and contract data overview with versioning